Introduction:

As we celebrate the one-year anniversary of Hybrid Finance Blockchain (HyFi), it's paramount to reflect on the revolutionary strides it has made in reshaping the financial landscape. HyFi stands at the intersection of traditional finance and blockchain technology, offering a dynamic and inclusive approach that empowers individuals and businesses with unprecedented opportunities. In this comprehensive blog, we will delve into the fundamentals of HyFi, exploring its core concepts, real-world applications, asset lifecycle, and the potential it holds to reshape the future of finance.

Understanding Hybrid Finance (HyFi):

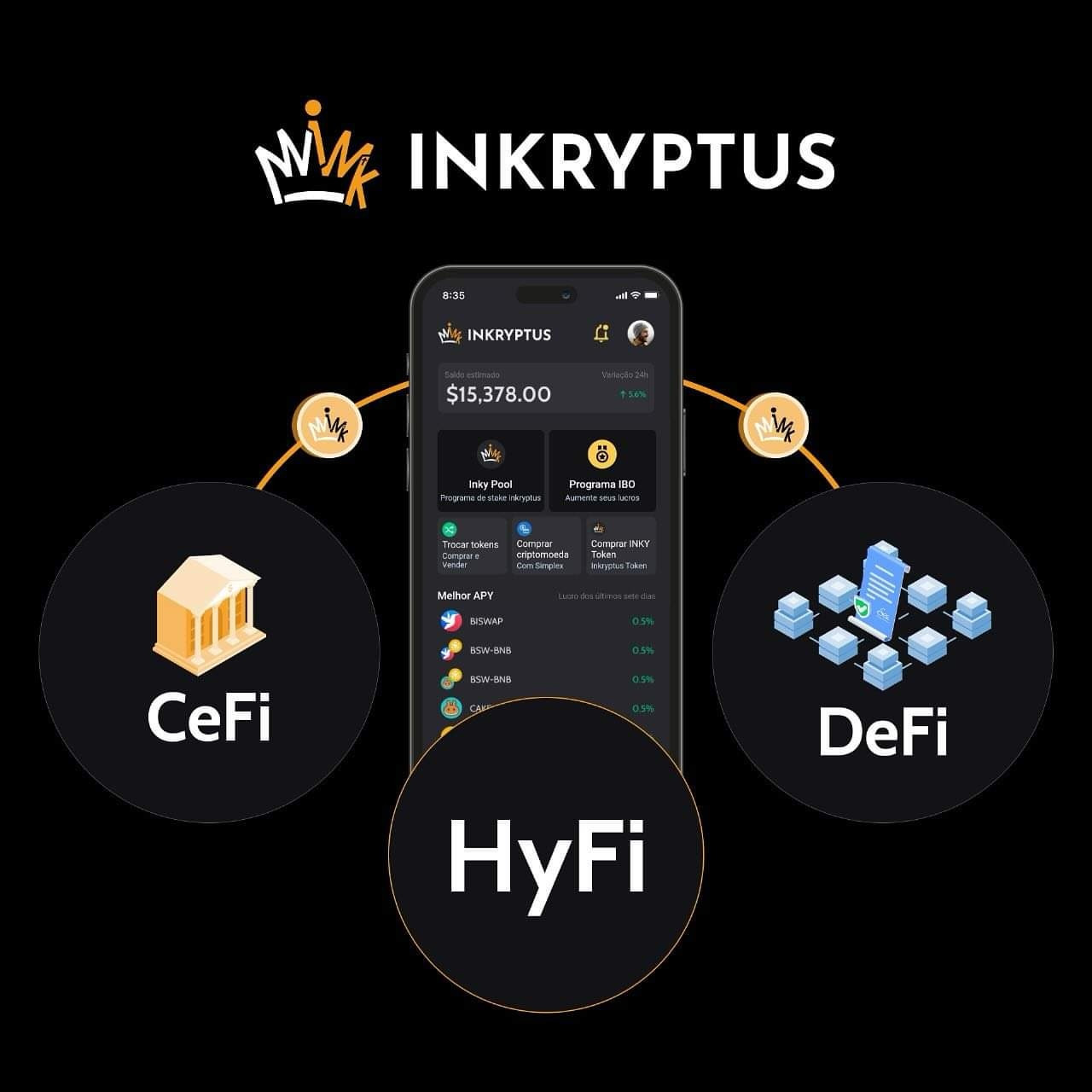

HyFi is a groundbreaking concept that bridges the proven principles of traditional finance with the innovative features of decentralized finance (DeFi). Traditional finance provides stability, regulatory compliance, and familiarity, while DeFi introduces decentralization, transparency, and smart contract automation. The marriage of these two worlds in HyFi results in a seamless financial framework that caters to the needs of individuals and businesses, offering enhanced control over assets, faster transactions, and broader access to financial services.

Tokenization and Fractionalization:

Two pivotal concepts underpinning HyFi are tokenization and fractionalization. Tokenization involves transforming real-world assets, such as real estate or commodities, into digital tokens on the blockchain. This process enhances accessibility, liquidity, and transparency. Fractionalization, on the other hand, allows the division of valuable assets into smaller shares, enabling a broader range of investors to participate in various markets. These concepts are revolutionizing how we own and invest in assets, fostering fairness and efficiency.

Real-World Applications of Hybrid Finance:

HyFi's impact is tangible in various real-world applications:

1. Tokenization of Real Assets: Tangible assets like real estate, art, and commodities can be tokenized, unlocking liquidity and enabling fractional ownership.

2. Cross-Border Payments: Blockchain technology streamlines cross-border transactions, reducing fees, transaction times, and enhancing security.

3. Decentralized Lending Platforms: Hybrid finance combines traditional lending with DeFi, creating decentralized lending platforms with competitive interest rates and flexible terms.

4. Hybrid Investment Funds: Investment funds leverage HyFi strategies, blending traditional and blockchain-based assets for diversified market exposure.

5. Regulatory-Compliant Token Offerings: Security token offerings (STOs) enable companies to raise capital while adhering to regulatory requirements.

6. Central Bank Digital Currencies (CBDCs): HyFi contributes to the development of CBDCs, enhancing payment efficiency with regulatory oversight.

7. Supply Chain Management: Blockchain enhances traceability, transparency, and efficiency in supply chain management.

8. Hybrid Payment Solutions: Integration of traditional payment systems with blockchain ensures faster, cheaper, and more secure transactions.

9. Compliant Tokenized Securities: Tokenized securities comply with regulations, providing an accessible method for investing in traditional financial markets.

10. Decentralized Identity Management: HyFi solutions blend traditional identity verification with decentralized systems for improved security and privacy.

Implementation Approach of Hybrid Finance:

The successful implementation of HyFi involves a meticulous process:

1. Comprehensive Analysis: Evaluate existing financial infrastructure to identify areas for blockchain and DeFi integration.

2. Blockchain Network Setup: Establish a secure and scalable blockchain network, selecting an appropriate platform and ensuring network security.

3. Smart Contract Development: Develop smart contracts to automate financial agreements, promoting seamless and transparent interactions.

4. Tokenization of Assets: Transform real-world assets into digital tokens for fractional ownership and liquidity.

5. Integration with Traditional Systems: Connect blockchain solutions with existing financial systems, facilitating seamless transactions.

6. DeFi Protocol Integration: Incorporate DeFi protocols for decentralized lending, yield farming, and liquidity provision.

7. Regulatory Compliance: Implement compliance measures within smart contracts and protocols to adhere to financial regulations.

8. Security Measures: Implement robust encryption, multi-factor authentication, and regular testing to safeguard sensitive financial data.

9. User Identity Management: Verify user identities securely to ensure privacy during financial interactions.

10. Continuous Improvement: Monitor, optimize, and adapt the HyFi system to evolving market demands and technological advancements.

Asset sequence in Hybrid Finance Blockchain:

The asset sequence in HyFi Blockchain comprises several stages:

1. Token Creation: Assets are tokenized, representing ownership or value on the blockchain.

2. Token Issuance: Tokens are issued and made available for trading on blockchain platforms.

3. Asset Trading: Tokens representing assets are freely traded on the blockchain, facilitating transparent transactions.

4. Fractional Ownership: Investors can buy fractional shares, increasing accessibility to a broader range of investors.

5. Asset Utilization: Assets can be utilized for various purposes throughout their lifecycle.

6. Value Appreciation: Token values fluctuate based on real-world asset movements, reflecting potential appreciation.

7. Governance and Voting: Some assets provide governance rights, allowing token holders to participate in decision-making processes.

8. Asset Management: Administrators oversee asset performance and compliance throughout its lifecycle.

9. Asset Redemption or Disposal: Tokens representing assets may be redeemed or disposed of at the end of their lifecycle.

10. Continuation or Tokenization of New Assets: The asset lifecycle is continuous, with new assets continually tokenized and added to the platform.

Security Features for Hybrid Finance Blockchain:

Ensuring the security of HyFi Blockchain involves implementing robust measures:

1. Encryption: Utilize strong encryption protocols to protect sensitive data, ensuring only authorized parties can access information.

2. Multi-factor Authentication (MFA): Add an extra layer of security for user logins and transactions.

3. Secure Smart Contracts: Conduct rigorous code auditing and testing to eliminate vulnerabilities in smart contracts.

4. Penetration Testing: Regularly test for weaknesses in the blockchain network's security.

5. Immutable Audit Trail: Leverage blockchain's immutability for transparent transaction records.

6. Permissioned Access: Limit access to sensitive functions and data to authorized users with role-based permissions.

7. Secure Key Management: Safeguard private keys with robust key management practices.

8. Consensus Mechanisms: Choose secure consensus mechanisms like Proof-of-Stake (PoS) or Proof-of-Authority (PoA).

9. Regular Updates and Patches: Keep blockchain software and protocols up-to-date with the latest security patches.

10. Secure Wallet Integration: Integrate with secure wallets that comply with industry standards and undergo thorough security testing.

Best Blockchain Frameworks for Hybrid Finance:

Several blockchain frameworks are suitable for HyFi:

1. Ethereum: Widely used for DeFi applications and asset tokenization with smart contract functionality.

2. Binance Smart Chain (BSC): Offers faster and cost-effective transactions, compatible with the Ethereum Virtual Machine (EVM).

3. Polkadot: Allows interoperability of multiple blockchains, suitable for complex financial applications.

4. Cardano: Known for security and sustainability, appealing for regulatory-compliant HyFi projects.

5. Avalanche: Fast, highly scalable platform for high-frequency trading and financial applications.

6. NEAR Protocol: Developer-friendly with high throughput and low latency, suitable for high transaction volumes.

7. Solana: High-performance platform capable of processing thousands of transactions per second.

Conclusion:

In conclusion, Hybrid Finance Blockchain (HyFi) stands as a transformative force in finance, offering a seamless blend of traditional principles and blockchain innovation. Tokenization, fractionalization, and real-world applications showcase its vast potential. The implementation approach, asset lifecycle, security features, and blockchain frameworks collectively contribute to the efficiency and security of HyFi. Embracing this innovative paradigm promises a more inclusive and efficient financial ecosystem. As we celebrate one year of HyFi, the journey ahead holds the promise of continual evolution and positive disruption in the world of finance.

1 comments

Izzy Smart

Wow just amaizing how web 3 and 2 are integrated