The Dormant Bitcoin Trend: A Glimpse into Long-Term Holder Strategy

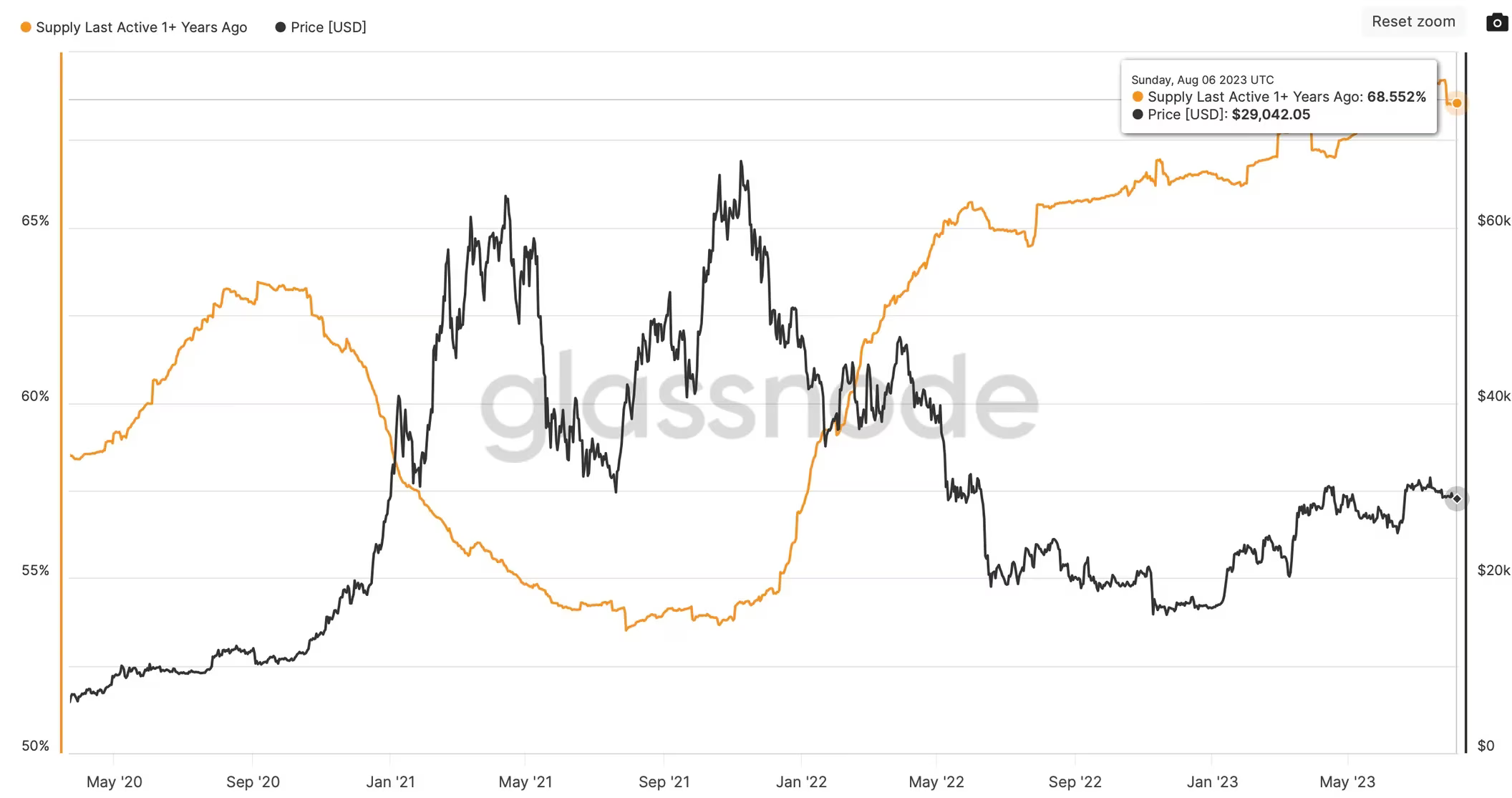

In the ever-evolving landscape of cryptocurrency, one intriguing trend has caught the attention of both analysts and investors alike: the increasing number of dormant Bitcoin holdings. Recent data from blockchain analytics firm Glassnode reveals that more than 13.3 million Bitcoins, with a staggering value of $388.7 billion, have been inactive on-chain for at least a year. This figure accounts for an impressive 68.54% of the total circulating supply of 19,451,256 BTC, reflecting a persistent preference for long-term holding strategies.

HODLing for the Future

Cryptocurrency exchange Bitfinex's analysts note that this tendency to hold onto Bitcoin for extended periods reflects a strong belief in its long-term value, even amidst the notorious market downturns witnessed over the past year. The trend highlights the resolute optimism of the crypto community, bolstered by unwavering faith in Bitcoin's potential for sustained growth.

Supply Constriction and Price Potential

The increasing prevalence of dormant Bitcoin holdings points to a gradual decline in available supply within the market. As more Bitcoin is tucked away by long-term holders, the supply-demand dynamics begin to favor the potential for a substantial price rally. The analysts at Bitfinex suggest that this scarcity, coupled with a growing demand, could drive Bitcoin's value upward, painting a bullish picture for its future.

The Impact of Financialization

It's important to note that while the dormant Bitcoin trend provides valuable insights into the market, it doesn't account for the full scope of Bitcoin's transformation. Over the years, various investment vehicles have emerged that allow investors to gain exposure to Bitcoin without directly owning it. These innovations, such as CME's cash-settled futures and exchange-traded funds (ETFs), have created alternative avenues for investors to participate in the cryptocurrency market. Known as liquid tradable proxies, these instruments also exert an influence on Bitcoin's price trajectory.

Conclusion: A Future of Steadfast Optimism

In the midst of evolving investment strategies and the maturation of the cryptocurrency ecosystem, the trend of dormant Bitcoin holdings speaks volumes about the enduring conviction in Bitcoin's value proposition. The willingness of long-term holders to weather market turbulence and patiently await the fruition of their investments showcases a belief that goes beyond short-term fluctuations.

As the supply of actively circulating Bitcoin diminishes and demand continues to grow, the stage is set for potential price fireworks. The cryptocurrency market's steadfast optimism, combined with the impact of financialization, is shaping a future where Bitcoin's potential knows no bounds. While uncertainties remain, the unwavering faith in Bitcoin remains a driving force, reminding us that only time will reveal the full extent of its transformative power.

0 comments